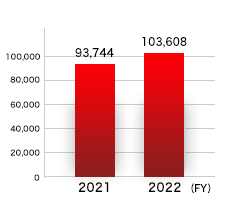

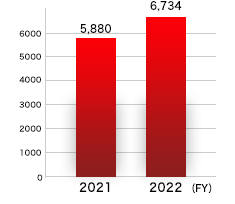

Financial Highlights

(Unit:Millions of yen)

| FY 2021 |

FY 2022 | ||

| Revenue |

93,744 (15.2%up) |

103,608 |

|

| Core operating income (Notes1) |

5,880 (19.1%up) |

6,734 |

|

| Operating income |

2,665 (50.4%down) |

8,259 |

|

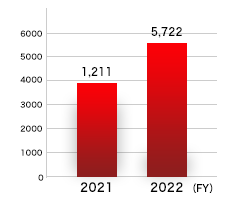

| Profit attributable to owners of parent |

1,211 (69.3%down) |

5,722 |

|

| Total assets |

116,381 (0.1%up) |

118,971 |

|

| Total equity |

72,429 (2.4%up) |

78,013 |

|

| Per |

Basic earnings per share (Yen) | 26.92 | 129.96 |

| Equity attributable to owners of parent per share (Yen) |

1,620.20 | 1,785.25 |

|

| Dividend per share (Yen) | 40 | 52 |

|

| ROE (%) |

1.7% |

7.6% |

|

| Notes 1: | Core operating income was calculated by deducting "cost of sales" and "selling, general and administrative expenses" from "revenue." |

|---|

| Revenue | Core operating income | Profit attributable to owners of parent | ||||||

|---|---|---|---|---|---|---|---|---|

| (Unit:Millions of yen) | ||||||||

|

|

|

||||||