Corporate Governance

Basic Stance on Corporate Governance

In order to improve sustainable growth and mid-to-long term corporate value, the Company, as a member of society, must adhere to the law and social norms.

In addition, we seek to create harmony starting with stakeholders including the customers who use the Bando Group’s products (end users), employees, business partners, shareholders, local communities. We believe it is especially important to gain people’s trust and build better relationships. In line with such thinking, the Company focuses on ensuring sound, transparent and efficient management by enhancing its corporate governance system.

Board of Directors

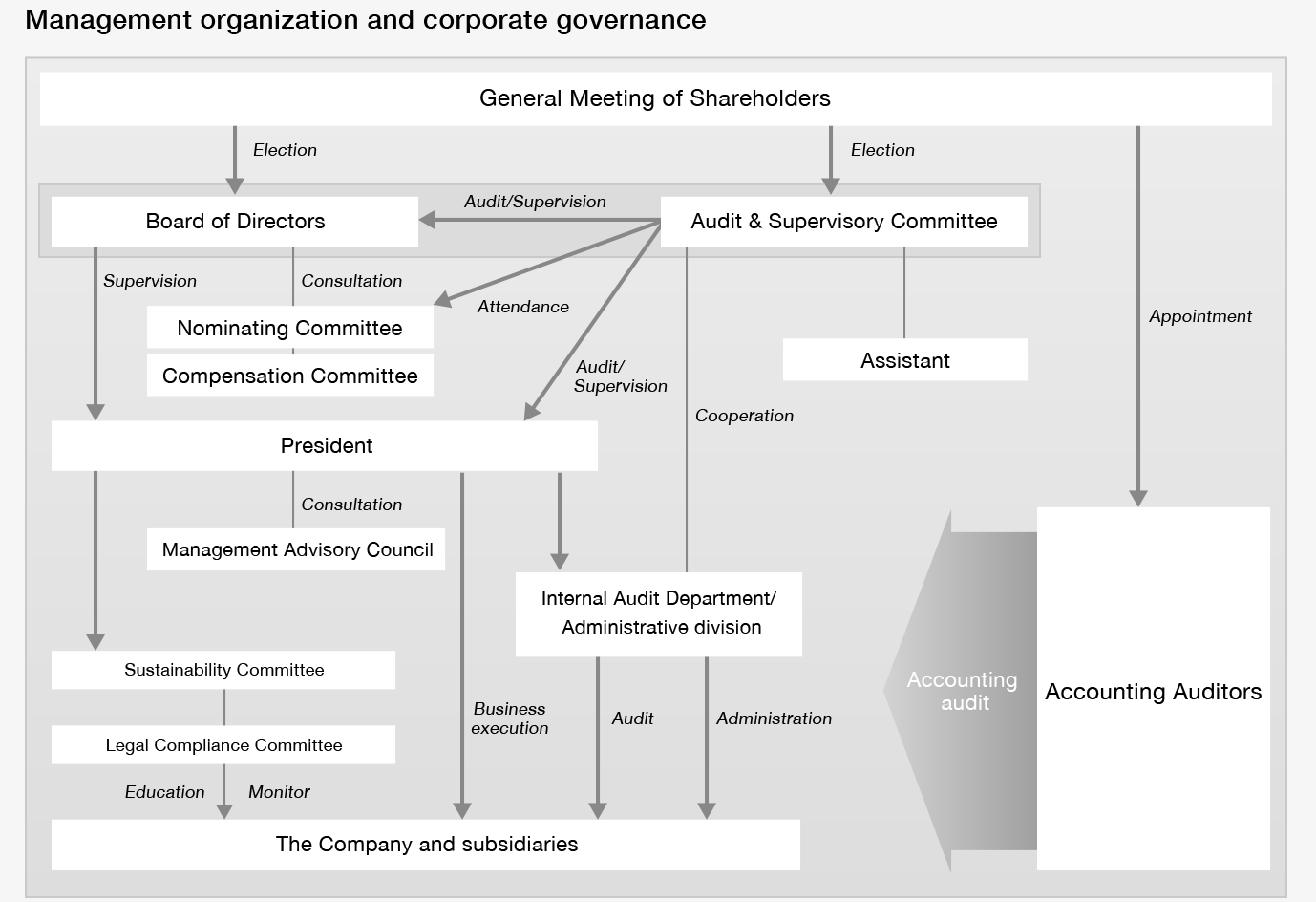

Bando aims to further enhance auditing and oversight functions by adopting a Company with an Audit & Supervisory Committee structure.

The Company’s Board of Directors consists of nine members, with four of those nine members serving as members of the Audit & Supervisory Committee. The Board makes decisions concerning basic management policies, important management issues, and legally stipulated matters, as well as monitoring the work performance of directors and corporate executive officers. The Board’s three external directors are charged with the independent oversight of business operations. The Board meets at least once a month. In addition, the Company maintains a corporate executive officer system to improve operational efficiency and speed, and has established the Management Advisory Council to assist the president with management decisions.

Audit & Supervisory Committee

The Audit & Supervisory Committee members comprise four directors, of whom three are external directors.

Furthermore, one of the directors serves on a full-time basis.

Nominating Committee and Compensation Committee

Although not required under the Companies Act, the Company has established the Nominating Committee and Compensation Committee as advisory bodies to the Board of Directors with an aim to further enhance corporate governance.

Specifically, the appointment of directors and the allocation of compensation are determined based on the deliberation at the Nominating Committee and Compensation Committee, made up of a majority of external directors and chaired by an external director, and the resolution at the Board of Directors. Meanwhile, the appointment of directors who are also Audit & Supervisory Committee members is determined with the consent of the Audit & Supervisory Committee, and the allocation of their compensation is deliberated at the Audit & Supervisory Committee.

Performance-linked Remuneration for Directors

The Company introduced performance-linked remuneration (monetary or stock remuneration) correlated to profit attributable to owners of parent for the purpose of heightening awareness of contributions to improving business performance and corporate value. Furthermore, we are introducing functions to serve as incentives to improve mid-to-long term performance results, such as stock-based remuneration received upon resignation (stock award points are granted each year based on business performance, and a number of shares equivalent to the accumulated points are issued at the time of resignation).

Method to Determine the Amount of Performance-linked Remuneration

Conditions for profit-linked bonus payment

Profit-linked bonus for directors who do not serve as Audit & Supervisory Board members (non-executive directors are not eligible for this benefit) will only be paid if the following conditions related to business performance are fulfilled at the end of the fiscal year.

∙ The dividend per share is more than ¥26 per year

∙ Profit attributable to owners of parent before payments of performance-linked remuneration for the fiscal year is more than ¥3,000 million

Calculation method for the total amount of profit-linked bonuses

The total amount of profit-linked bonuses to be paid to directors is calculated using the following formula.

However, in accordance with this calculation method, the fixed upper limit for the total amount of profit-linked bonuses is ¥50 million.

∙Total amount of profit-linked bonuses

= standard profit x 0.004 x (1.05)n-4

*n = Number of directors

Standards for stock remuneration payment

The amount of stock remuneration is calculated by multiplying the above formula for total amount of profit-linked remuneration by performance-linked factors, and dividing it by the stock price as of March 31, 2023 (1,058 yen, the closing price at the end of the fiscal year) to derive annual stock award points. However, the fixed upper limit for the total amount of payment by position per fiscal year based on this formula shall be ¥60 million (56,700 shares). Also, 70% of the cumulative total of stock award points granted during the tenure of an eligible director shall be granted in the form of the Company’s shares at the time of his/her retirement, with the remaining 30% to be paid in money equivalent to the amount realized through sales in the market by the stock award trust to prepare for the payment of income and other taxes.

Independence Standards and Qualification for Independent Directors

The Company determines that an external director is independent if none of the followings applies:

1. A person is or was a business executor of the Group (i.e. executive director, corporate executive officer, manager or other employees)

2. A person who falls under any of the following in the past five fiscal years:

(1) His/her close relative is a business executor of the Group

(2) The Group’s major shareholder or its business executor

(3) The Group’s major business partner or a person whose major business partner is the Group or its business executor

(4) The Group’s major lender or its business executor

(5) A person who belongs to an audit firm that performs statutory audit of the Company

(6) A consultant, accounting expert such as certified public accountant or legal expert such as lawyer who has received a large amount of

cash or other financial benefits from the Company in addition to directors’ compensation

(7) A business executor of a company in which our officer holds a concurrent position

(8) A person who has received a large amount of donation from the Company

3. A person whose term of office as an external director of the Company exceeds eight years

4. A person who is deemed to be in special circumstances that may give rise to a conflict of interest with ordinary shareholders in consideration of other circumstances practically and comprehensively

Haruo Shimizu

Many years of global business development experience gained working in manufacturing firms and a related wealth of knowledge enable Mr. Shimizu to conduct auditing and oversight activities from an independent perspective. In addition, Mr. Shimizu concurrently holds the position of Outside Director at Suminoe Textile Co., Ltd., and Outside Director at Ashimori Industry Co., Ltd. As the Company does not have any special relationship with Suminoe Textile Co., Ltd. or Ashimori Industry Co., Ltd. In addition, Mr. Shimizu satisfies the Company’s independence standards for external directors and there is no conflict of interest with ordinary shareholders as defined by the Tokyo Stock Exchange, and Mr. Shimizu has a high degree of independence.

Sayuri Yoneda

Broad auditing experience and a related advanced financial and accounting expertise as a certified public accountant enable Ms. Yoneda to conduct auditing and oversight activities from an independent perspective.

In addition, Ms. Yoneda concurrently holds the position of head at Yoneda Certified Public Accountant Office, and External Audit & Supervisory Committee member of AMATEI INCORPORATED. As the Company does not have any special relationship with Yoneda Certified Public Accountant Office or AMATEI INCORPORATED. In addition, Ms. Yoneda satisfies the Company’s independence standards for external directors and there is no conflict of interest with ordinary shareholders as defined by the Tokyo Stock Exchange, and Ms. Yoneda has a high degree of independence.

Kenji Tomida

Many years of experience in finance, accounting, and overseas business gained working in manufacturing firms and deep knowledge as manager enable Mr. Tomida to conduct auditing and supervise activities from an independent perspective. In addition, Mr. Tomida satisfies the Company’s independence standards for external directors and there is no conflict of interest with ordinary shareholders as defined by the Tokyo Stock Exchange, and therefore he has a high degree of independence.

Analysis and evaluation of the effectiveness of the Board of Directors

For analysis and evaluation of the effectiveness of the Board of Directors, the Board of Directors carried out a self-evaluation survey in regards to their operation and management style and the chair of the Board of Directors carried out his own analysis and evaluation of directors’ self-evaluation. Those results were reported to the Board of Directors and discussed.

As a result, the Board of Directors of the Company reached the conclusion that there are no issues with respect to its effectiveness overall as it conducts active discussions from various perspectives among members who are well-balanced in terms of knowledge, experience, and abilities.

Evaluation results for the fiscal 2022 goal

In 2022, the Company’s Board of Directors set a goal to “enhance strategic discussions toward the achievement of the targets under the mid-to-long term business plan” and has discussed various issues in preparation for the development of the next business plan starting in fiscal 2023 in addition to the main issues toward the achievement of the goals of the plan.

As a result, although there are some issues to overcome, we were able to share our recognition of measures to achieve the next plan as well as concerns through discussions from multiple perspectives.

On the other hand, in light of changes in the business structure and diversification of values, we confirmed the need to further enhance discussions at the Board of Directors meetings in order to increase corporate value over the mid-to-long term.

Goals for fiscal 2023

For fiscal 2023, the Company’s Board of Directors set a goal to "enhance discussions to increase mid-to-long term corporate value taking into account changes in business structure and diversification of values."

Policy for Constructive Dialogue with Shareholders

Regarding all shareholders and investors as important stakeholders, the Company believes it is important to deepen mutual understanding based on a constructive dialogue about how to enhance corporate value and to use such dialogue as the basis for proper management policy. In line with such thinking, the executive director in charge of finance oversees the dialogue in coordination with the central departments responsible for finance, general affairs and corporate planning and provides briefings to domestic and foreign institutional investors, and disclosure of information such as the details and progress of business plans, Group performance, and returns to shareholders. In these meetings, the president and the senior management of the Company seek to engage in dialogue with institutional investors about long-term creation of corporate value so that stakeholder views can better be reflected in the management of the business. The full online disclosure of any materials presented at such meetings via the Company’s website ensures fair disclosure to individual investors and shareholders. Since the General Meeting of Shareholders also provides another valuable opportunity to engage with shareholders, the Company seeks to avoid holding it on the most popular dates, and also ensures that adequate time is allocated to the Q&A session.

The content of dialogue with shareholders and investors is reported as necessary to the Board of Directors, and executive officer meetings. The Company has also instituted policies on disclosure and insider trading as part of efforts to prevent any occurrence of insider trading.

* Details of the Company’s disclosure policy

https://www.bandogrp.com/eng/ir/management/disclosure.html

Disclosures Based on Principles of Japan’s Corporate Governance Code

The Company complies with the principles of the Corporate Governance Code.

[Principle 1.4] Cross-Shareholdings

Cooperative relationships with a range of firms across fields such as financing, development, procurement, production and sales are essential if the Company is to prevail as a manufacturer of rubber and plastic components against fierce global competition. The Company’s policy is to own shares in suppliers where it is judged that, in line with business strategy, maintaining or strengthening stable, long-term commercial relationships with such firms would contribute to the enhancement of the Bando Group’s corporate value over the mid-to-long term.

The Board of Directors conducts a review of cross-shareholdings each year, investigating and verifying items such as whether benefits or risks are commensurate with capital costs, in addition to compatibility with the Company’s retention policies. Cross-shareholdings will be reduced if they are determined to have little significance to the Company.

As a result of verifying the status of related profits for all individual stocks, such as dividends compared against capital cost for balance sheet amounts or related trading profit, the Company confirmed that related profit exceeded capital cost for most of the items applicable for verification. Overall, the Company confirmed that there was qualitative significance for all individual stocks. Consequently, due to dilution of significance for retained cross-shareholdings, the Company confirmed it will consider disposal by sale for some indexes going forward and sold a part of those indexes in fiscal 2022.

Decisions relating to the exercise of any voting rights pertaining to cross-shareholdings are taken based on a general consideration of whether the proposed voting resolution is (a) consistent with the aforementioned policy, and (b) likely to contribute to the enhancement of the corporate value of the equity issuer over the mid-to-long term.

As a shareholder of the supplier, it is our policy to veto any resolutions carrying significant concerns for damage to the corporate value of the Bando Group.

[Principle 2.6] Roles of Corporate Pension Funds as Asset Owners

The Company uses its corporate pension reserves through the Bando Chemical Industries Corporate Pension Fund (hereafter “the Pension Fund”). In addition to formulating basic policies regarding management of the Pension Fund, we established a steering committee to operate, manage, etc. reserve funds. Individuals who possess expert knowledge on finance are appointed as members of the steering committee. We also contract multiple managing bodies for the reserve to ensure there are no conflicts of interest between corporate pension beneficiaries and the Company. Furthermore, additions or changes to the managing bodies or the managed products are approved by the Pension Fund council and representative council after deliberation by the steering committee. All managing bodies have announced their acceptance of the Stewardship Code.